Identity Document Liveness Detection

Detects document presentation attacks in digital onboarding

The First and Only Complete Document Liveness Detection Solution for Digital Onboarding

Taking a picture of a document and presenting it for verification is the foundation of digital onboarding and KYC verification. People do it every day to open bank accounts, access government services, cross borders, start new jobs, enroll in online courses, and more. But so do fraudsters.

With 70% of fraud in digital onboarding and KYC happening with document fraud—or document presentation attacks—identity verification is a critical line of defense against the financial and reputational damage of document fraud. That’s where document liveness detection software comes in. It detects when an identity document is not genuine but instead a document presentation attack.

Experience advanced identity verification with our cutting-edge document liveness detection and biometrics product suite.

Our IDLive® Doc suite is the top document liveness detection solution.

It is the ultimate in identity document verification from a leader in document liveness detection software and biometrics. Developed by skilled data scientists using advanced neural network technology, the product suite provides near complete, accurate document liveness detection with a friction-free experience that’s seamless for genuine users.

Pioneering Technology

1st and only complete document liveness solution

Fast and Accurate Responses

1 second document liveness checks

Trusted Track Record

Over 200,000,000 documents protected

With our product suite, you can address the three most common presentation attacks universally across all the common types of identity documents anywhere in the world without needing to train on document templates.

Choose the entire suite or tailor your bundle to meet your organization’s identity verification needs for digital onboarding.

IDLive® Doc for Screen Replay Attacks

Targets fraudsters presenting documents that are displayed on a digital screen such as a high-resolution monitor, tablet, or mobile phone.

IDLive® Doc for Printed Copy Attacks

Targets fraudsters presenting documents that are copied, printed on paper, and then cut to size. *Does not work with documents originally printed on paper.

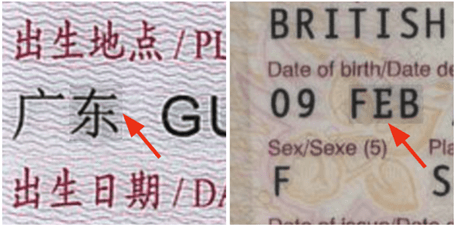

IDLive® Doc for Portrait Substitution Attacks

Targets fraudsters presenting documents with an altered facial portrait image, such as an overlay.

“ID R&D’s IDLive Doc saved RealAML years of in-house development, helped acquire new customers, and immediately demonstrated its ability to stop fraud attacks. IDLive Doc integrated seamlessly into our existing KYC process without disrupting other core components.”

– Jordan McCown, CEO and Co-founder, RealAML

Document Liveness Detection Done Right

Get everything you need to detect document presentation attacks while preserving the customer experience during digital onboarding.

Improve accuracy over manual review—especially with attack images from high-resolution displays that the human eye can’t detect.

Each product in the suite is tuned to minimize rejection of genuine documents while catching the vast majority of attacks.

Rely on a passive, single-image approach without complex instructions and no change to your existing user interface.

Reduce costs by automating an otherwise manual process; only live photos proceed to the next step.

Detect attacks when they happen to increase the risk and cost for bad actors, and prevent document fraud before it causes financial damage.

Analyze any identity document as soon as it hits the market, without the need for templates, model retraining, or implementation effort.

Detect fraud passively and transparently without revealing to fraudsters that countermeasures are in place or how they work.

Deploy on prem or to your cloud as a Docker or SDK. Easily integrate with your existing digital onboarding tech stack, using a single API call and the document image you already collect.

Proactively identify identity spoofing in real time without manual review by humans—with document liveness detection in one second.

Know that our technology is continually evolving to stay ahead steps ahead of fraudsters and emerging identity spoofing techniques.

Get Document Liveness Detection in Just Hours: Key Technical Specs

- Image orientation: portrait or landscape

- Minimum image size: 1920×1080 px, also known as FHD or 1080p

- Class of supported documents: passports, national IDs, driver’s licenses, and other documents used for identification

- Allowed compression: JPEG 70-100

- Supported operating systems: Linux and Windows

- Deployment modes: Docker or SDK

- After installation, it takes just one API call with a payload of the same image already captured to verify documents.

IDLive Doc detects document liveness from a single image frame. Learn more about how it works.

Related Resources

Analysis shows a 42% reduction in fraud by adding document liveness to identity verification

Have questions? Explore our FAQs to find all the answers you need.

Total Liveness Detection

At ID R&D, we are future proofing human verification in the era of AI. We are the only company to offer liveness detection capabilities for fraud across face, document, and voice. And as new vectors arise, we will be there. Always vigilant. Always innovating. Always steps ahead of fraudsters.