Think cybercrime won’t impact you personally? What about your business? The statistics tell a different story.

Think cybercrime won’t impact you personally? What about your business? The statistics tell a different story.

October is National Cybersecurity Awareness Month (NCSAM)– a fitting month to incite a little fear around the dangers of not being vigilant when itcomes to security. The aim of the cybersecurity awareness month is to “encourage personal accountability and proactive behavior in digital privacy, security best practices, common cyber threats and cybersecurity careers.”

There are hundreds of articles filled with tips about all the things you should do (and not do) to protect yourself. Unfortunately, the warnings are often ignored. With an increase in digital transactions and rising fraud related to the COVID pandemic, it’s more important than ever for businesses and consumers to be on guard. These cybersecurity statistics underscore the dangers of being careless.

Following are 13 scary cybersecurity statistics to encourage greater cyber awareness and action (scroll for Infographic)

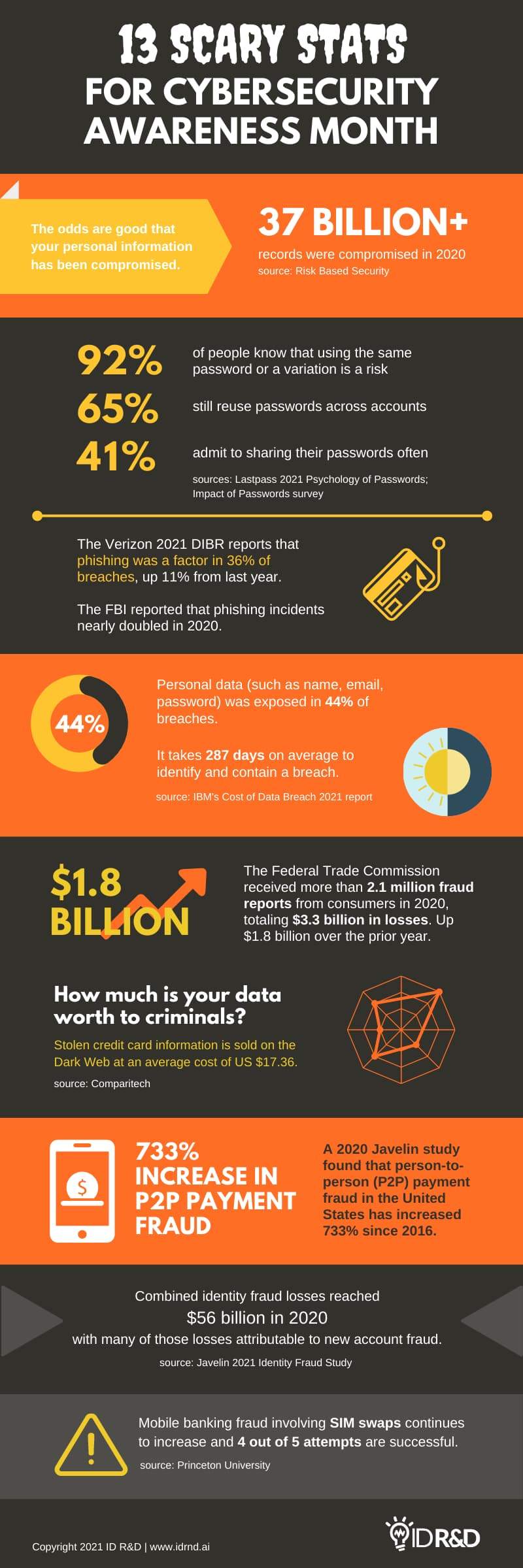

- The odds are good that your personal information has been compromised.

According to the Risk Based Security 2020 year-end data breach report, more than 37 billion records were compromised in 2020.

-

LastPass’ 2021Psychology of Passwords global report found that 92 percent of people know that using the same password or a variation is a risk, yet 65 percent still reuse passwords across accounts, leaving them susceptible to account takeover attacks and other financial fraud.

-

Bad password hygiene is rampant. The Impact of Passwords survey found 52% of respondents have shared at least one password, while 41% say they share passwords often. Speaking of bad password hygiene, here is a recent look at the 20 most hacked passwords in the world. Is your password on the list?

-

According to the FBI, phishing was the most common type of cybercrime in 2020 — with incidents nearly doubling in frequency, from 114,702 in 2019, to 241,324 in 2020.

-

Verizon also reported that phishing remains a top action in breaches. According to its 2021 DIBR, phishing was a factor in 36% of breaches, up 11% from last year.

-

IBM’s Cost of Data Breach 2021 report found that customers’ personal data (such as name, email, password) was exposed in 44% of breaches.

-

By the time you’re notified of a breach, credit card details, passwords and personal information like social security numbers may already be compromised. IBM reports that, on average, companies take 287 days to identify and contain a breach.

-

The Federal Trade Commission received more than 2.1 million fraud reports from consumers in 2020, totaling $3.3billion in losses. That’s up from $1.8 billion in 2019.

-

According to Javelin’s 2021 Identity Fraud Study combined identity fraud losses reached $56 billion in 2020, with many of those losses attributable to new account fraud.

-

Comparitech researchers report that stolen credit card information is sold on the Dark Web at an average cost of US $17.36.

-

Norton reports that 58% of adults are more worried than ever about being a victim of cybercrime.

-

A 2020 Javelin study found that person-to-person (P2P or peer-to-peer) payment fraud in the United States has increased 733% since 2016. P2P payments offer the ability for people to transfer money to one another for everything from rent to splitting a tab – think Zelle, Venmo, PayPal, Square Cash, or Google Wallet.

-

Mobile banking fraud involving SIM swaps continues to increase and 4 out of 5 attempts are successful. This tactic is a type of account takeover that enables criminals to target weakness in two-factor authentication to access bank accounts and more. This Princeton University study involved 50 attempts across five North American prepaid telecom carriers to port a stolen number. It found that all carriers used “insecure authentication challenges that could be easily subverted by attackers.” Learn the benefits of biometrics for two-factor authentication.

Don’t become a cybersecurity statistic! We encourage you to take action to keep yourself, your customers and your business safe. Resources include:

- Get information on keeping your business secure at https://staysafeonline.org/

- In the US, consumers can report fraud including Coronavirus scams at https://reportfraud.ftc.gov/#/

- In the UK, businesses can report cyberattacks at https://www.actionfraud.police.uk/

- Report cybercrime in Europe at https://www.europol.europa.eu/report-a-crime/report-cybercrime-online