Regulated companies must follow Know Your Customer (KYC) procedures. For financial institutions in the US, the KYC onboarding process is not just about managing risk, but compliance with Anti-Money Laundering Laws (AML) and the US Patriot Act’s Customer Identification Program (CIP) provision. Similar practices for preventing money laundering, terrorist financing and theft are followed worldwide.

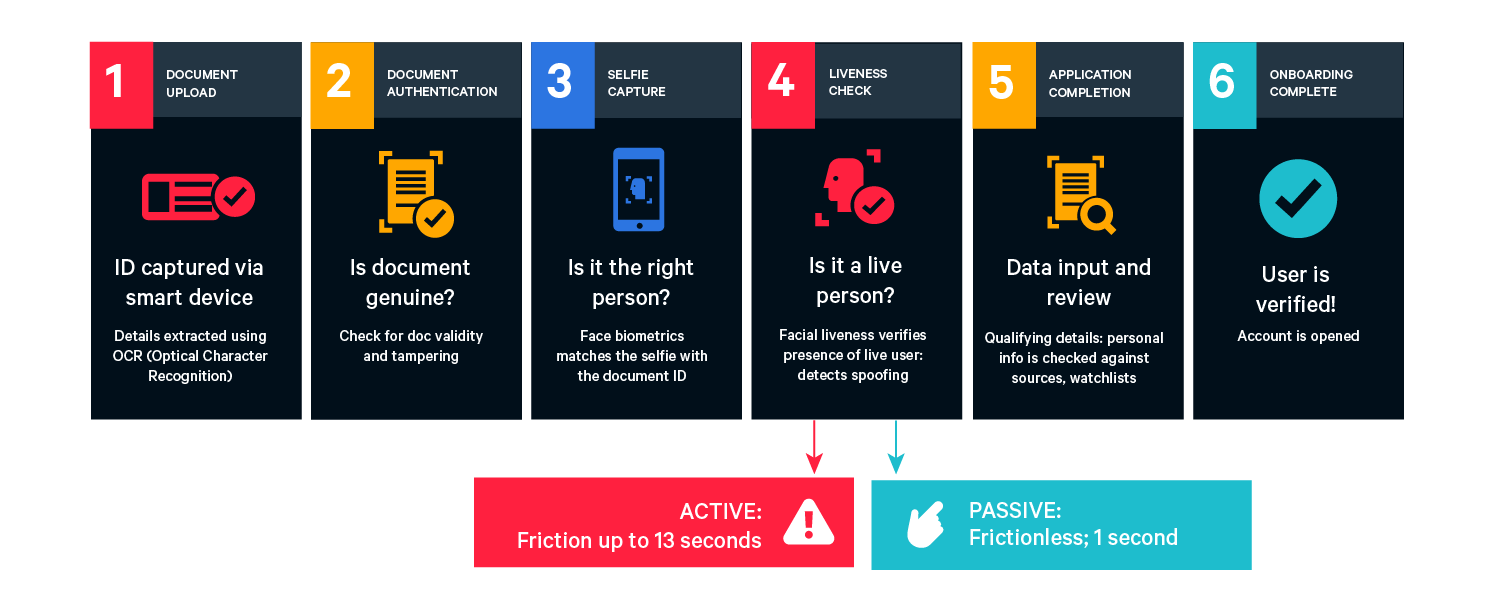

Identity verification is a critically important component of KYC and the process of digital onboarding for banks and financial services. r